The Quarterly Club

Education and resources to help more women become financially independent and build their confidence.

Personal & Professional Development

Financial literacy isn’t just about numbers—it’s about confidence, independence, social justice, and building a life you love.

We help women create strong financial foundations through expert-led education, practical tools, and a supportive, judgment-free space. Whether you're starting fresh or leveling up, we’re here to guide you every step of the way.

What we’re all about…

-

✺

Financial Literacy

-

✺

Empowerment & Indepedence

-

✺

Actionable Strategies

-

✺

Intersectional Feminism

-

✺

Values-Led Approach

-

✺

Personal & Professional Development

NEW!

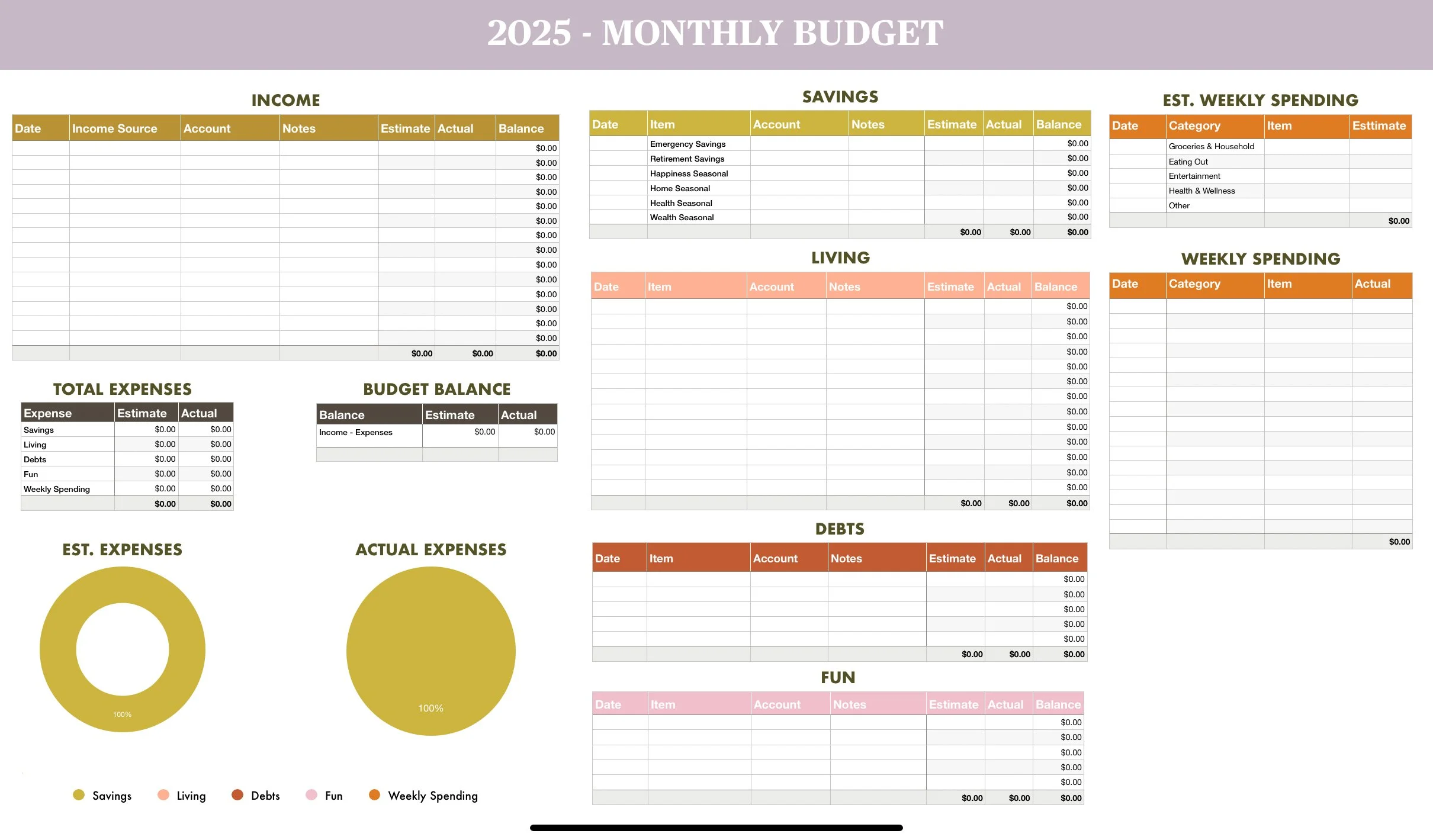

The Dashboard

Your Accountability Bestie: Budget & Goal Tracker

Your all-in-one digital dashboard designed to help you not just set financial goals, but actually achieve them. With built-in strategy this powerful tool helps you track spending, stay on budget, and make progress toward the life you want. No more guesswork, no more overwhelm—just clear, simple steps to financial confidence and freedom.

NEW!

Financial Foundations

Financial Literacy: The Course That Changes Everything

Money isn’t just about numbers—it’s about mindset, awareness, and strategy. Financial Foundations gives you the tools, knowledge, and confidence to take control of your finances and build a secure future. Through inspired, actionable steps, you’ll learn how to clear debt, build an emergency fund, and create a financial plan that actually works.

Paired with the The Dashboard, this course turns intention into action—so you can stop stressing about money and start living an aligned life.

✺ Frequently asked questions ✺

-

💡 Solution: Clear, guided steps that make financial literacy feel simple and achievable.

✅ How We Address It:

✔ Structured, Step-by-Step Approach – No guesswork—just follow the process and implement at your own pace.

✔ Workbook & Checklists – Actionable steps help you break things down into manageable tasks. -

💡 Solution: No pressure, flexible learning.

✅ How We Address It:

✔ Self-Paced & Designed for Real Life – No deadlines, no pressure—complete in a day or over weeks.

✔ Bite-Sized Lessons – Watch a video, complete an action step, and move at your own pace. -

💡 Solution: Mindset-first approach + a tool that actually works.

✅ How We Address It:

✔ Not Just Numbers—Mindset & Strategy – Learn to shift your relationship with money, so budgeting becomes empowering, not restrictive.

✔ The Dashboard: Financial & Goal Tracker – A guided system that helps you make financial progress without complex spreadsheets.

-

💡 Solution:Real-world strategies, designed by an expert with proven experience.

✅ How We Address It:

✔ Taught by an Expert – Created by a M.Ed. professional with 10+ years of experience helping people navigate financial decisions.

✔ Actionable & Research supported – Practical strategies you can apply immediately - oh and proven by science (because we like that over here). -

💡 Solution: Built-in accountability tools to keep you on track.

✅ How We Address It:

✔ Goal-Setting Framework Inside the Course – Set clear, motivating goals so you stay committed.

✔ Budget & Goal Tracker – Visual progress keeps you engaged and moving forward. -

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.